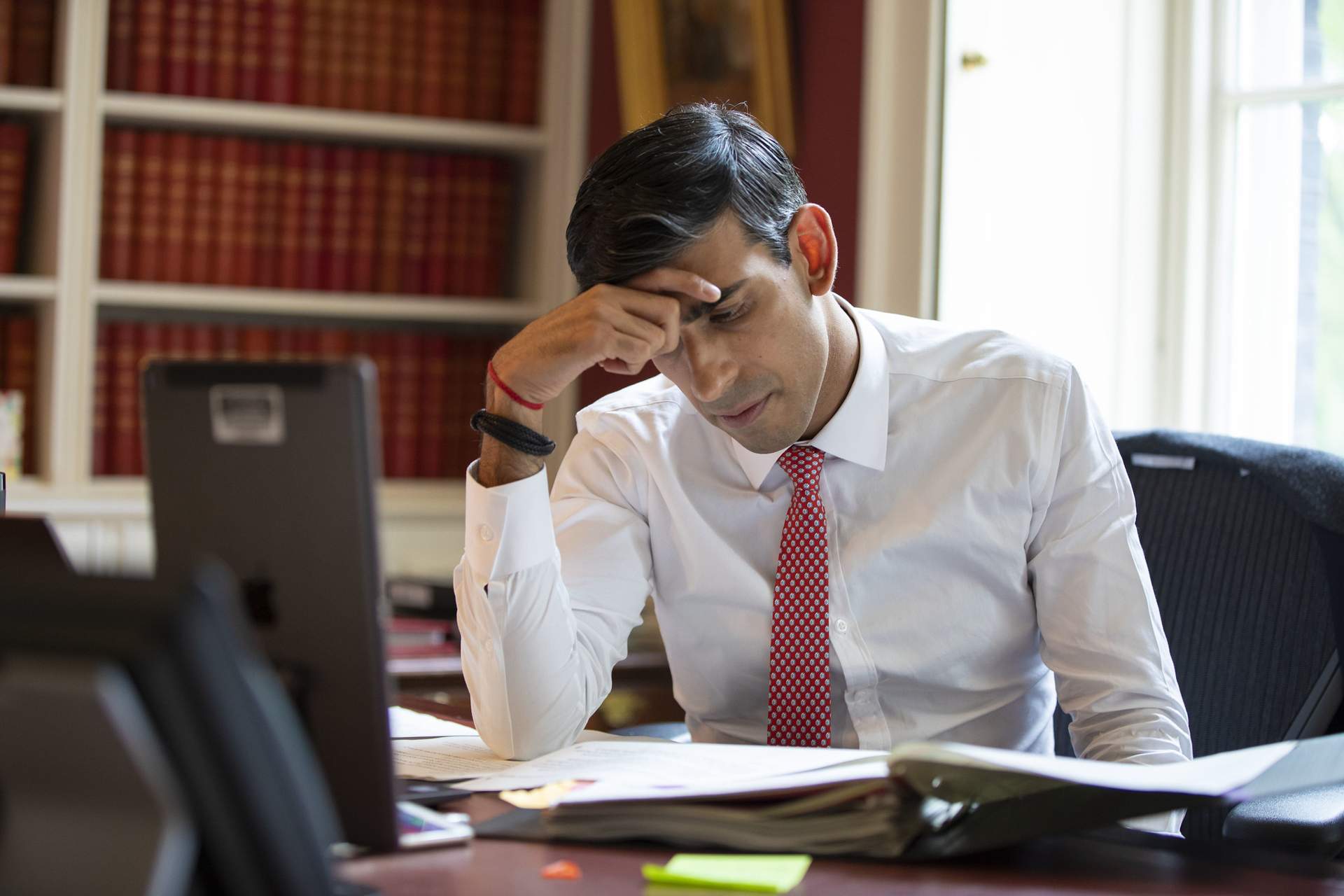

Britain is sitting on a mountain of debt – but there is a way to climb down

1 min read

The UK’s public finances – a source of perennial debate amongst politicians, think tanks, economists and investors – are in focus like never before. Covid-19 has ushered in a period of unprecedented public spending, funded in the main by large amounts of debt. Government borrowing – money it needs to borrow to pay for spending…

The UK’s public finances – a source of perennial debate amongst politicians, think tanks, economists and investors – are in focus like never before. Covid-19 has ushered in a period of unprecedented public spending, funded in the main by large amounts of debt.

Government borrowing – money it needs to borrow to pay for spending obligations which are not covered by tax receipts – was reported last week as hitting £303.1bn in the year to March. That figure is nearly £205bn higher than the previous year. Borrowing hit £28bn in March alone, a record monthly high. Often likened to a mountain, the UK’s debt monolith is viewed by some as a terrifying and unnavigable edifice. A Mount Doom, glowering ominously, portending calamity

Related Blogs

The Market is Tough, But Talent is Abundant – Why Are So Many Great IT Professionals Still Available?

Combating Financial Crime in the Financial Services Industry: A Look at Recent Trends and Technologies